Capital Gains Tax Abandoned

Last week, after years of research and speculation, Jacinda Ardern announced the New Zealand Government would not instate a capital gains tax on property:

After forming a government that represented the majority of New Zealanders, we have been unable to build a mandate for a capital gains tax. While I have believed in a CGT, it's clear many New Zealanders do not. That is why I am also ruling out a capital gains tax under my leadership in the future.

In the context of a mounting affordability crisis, I can't see this as anything but a momentous display of self-interest. Michael Cullen, a former finance minister who's spent the last few years investigating tax reform, puts it in plain terms:

The problem we have is New Zealanders seem not to want an inheritance tax, or a wealth tax, or a land tax or a capital gains tax but they still want to complain about growing inequality of wealth.

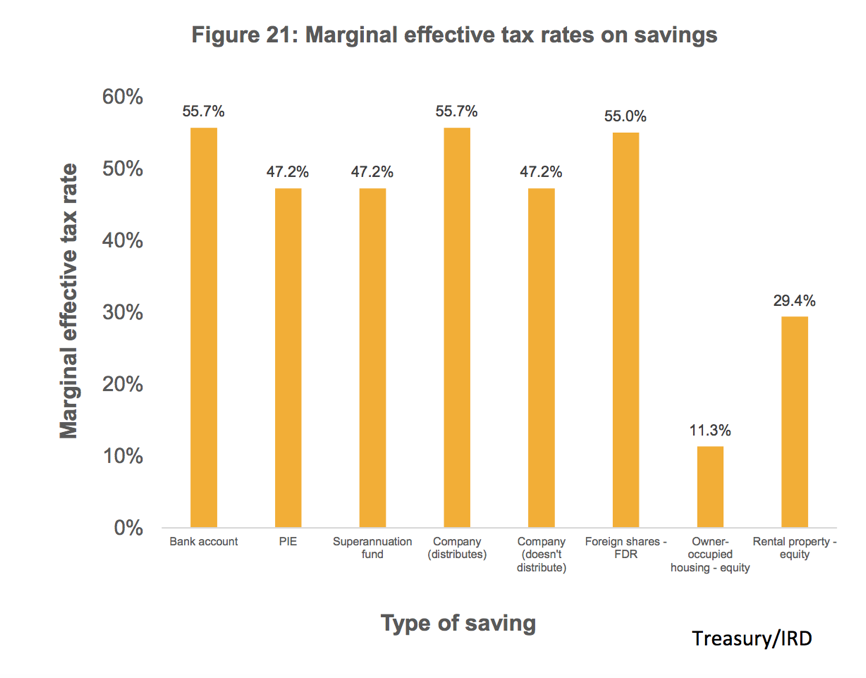

For me this chart from Jesse Mulligan's op-ed in 2018 says it all:

When the system so plainly favours housing it's no wonder so much of our nations wealth is tied up in our homes. Why invest anywhere else when you stand to gain the most from real estate? And here's the double-whammy: most of our banks are foreign-owned. Not only are we chosing to perpetuate our system's inequities: we're collectively agreeing to siphon our countries wealth offshore for generations to come.

The media portrayal of this debate was generational struggle: Millenials desperate for housing verses Boomers hoping to maintain their equity. But that narrative betrays the truth of it, as Mulligan points out here:

For all that this was pitched as a generational battle, the baby boomers’ house price gains were already locked in – the new tax would apply only to gains made after 2021, disproportionately affecting (you guessed it) millennials and first home buyers.

Even an unfair deal wasn't good enough to change the status quo.